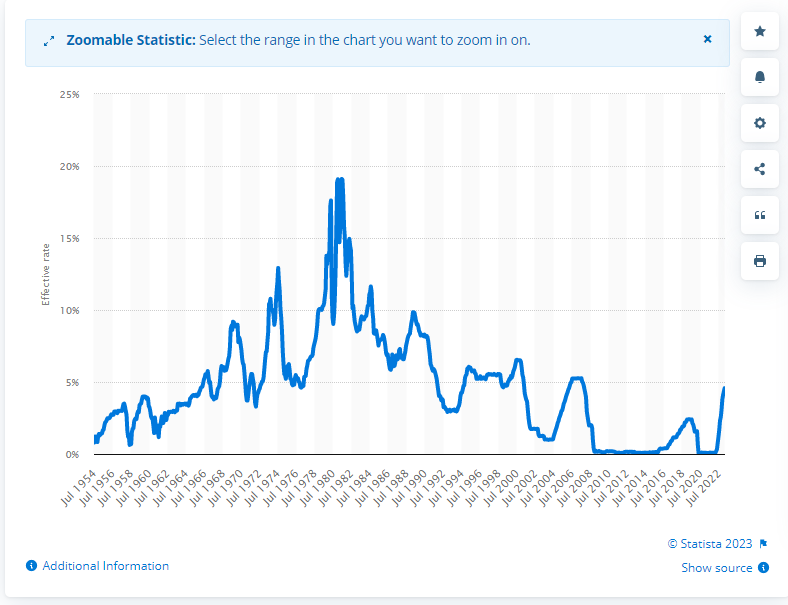

The U.S. federal funds effective rate was drastically lowered between February and April 2020. It dropped from 1.58 percent in February that year, down to 0.65 in March, and further down to 0.05 in April. The lowered rate was a response to the COVID-19 pandemic, as with the reason for the Federal Reserve’s quantitative easing during the same period. After several slight changes in the effective rate since, it was set to 0.33 percent in April 2022, and it kept increasing in the following months. As of February 2023, the U.S. federal funds effective rate stood at 4.57 percent.

What is federal funds effective rate?

The U.S. federal funds effective rate determines the interest rate paid by depository institutions, such as banks and credit unions, who lend reserve balances to other depository institutions overnight. Changing the effective rate in times of crisis is a common way to stimulate the economy, as it has a significant impact on the whole economy, such as economic growth, employment, and inflation.

Central bank policy rates

The United States was not the only country to adjust their effective rate, or other depositary interest rates, as a response to the economic effects of the coronavirus pandemic. All over the world, governments and central banks took actions to minimize the economic crisis. Most countries lowered their central bank policy rates in early 2020, and it was not until a year later that most countries started to slowly increase it again.